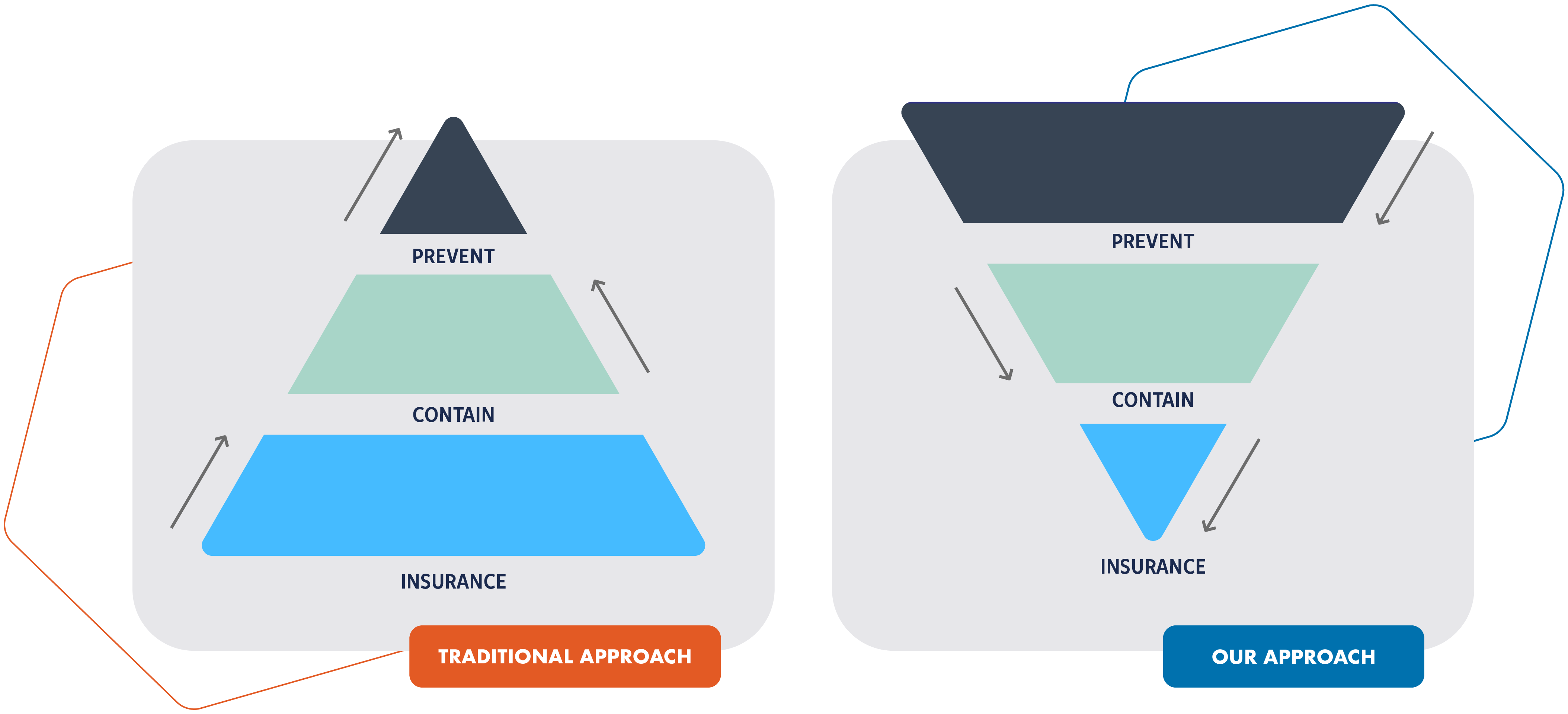

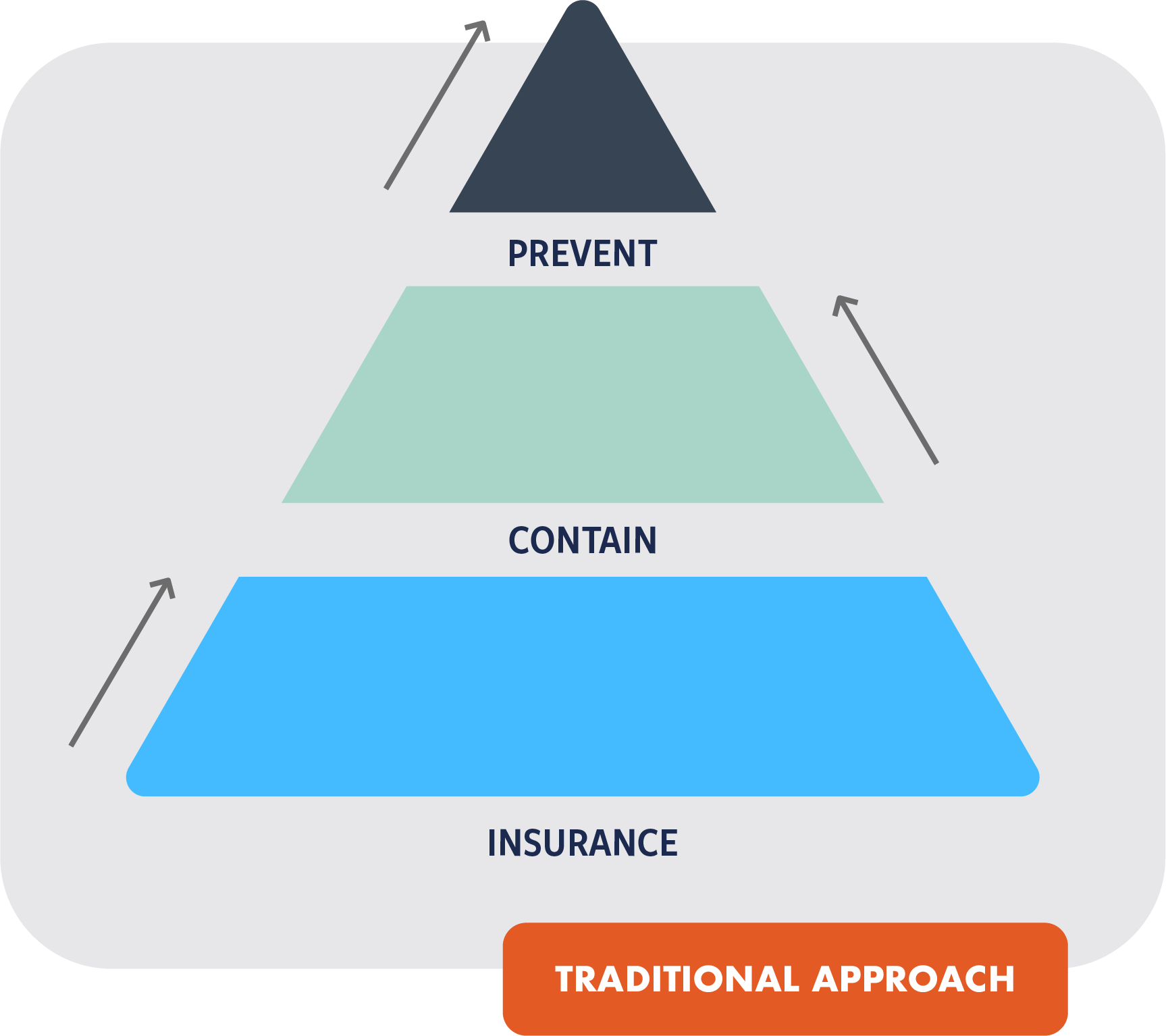

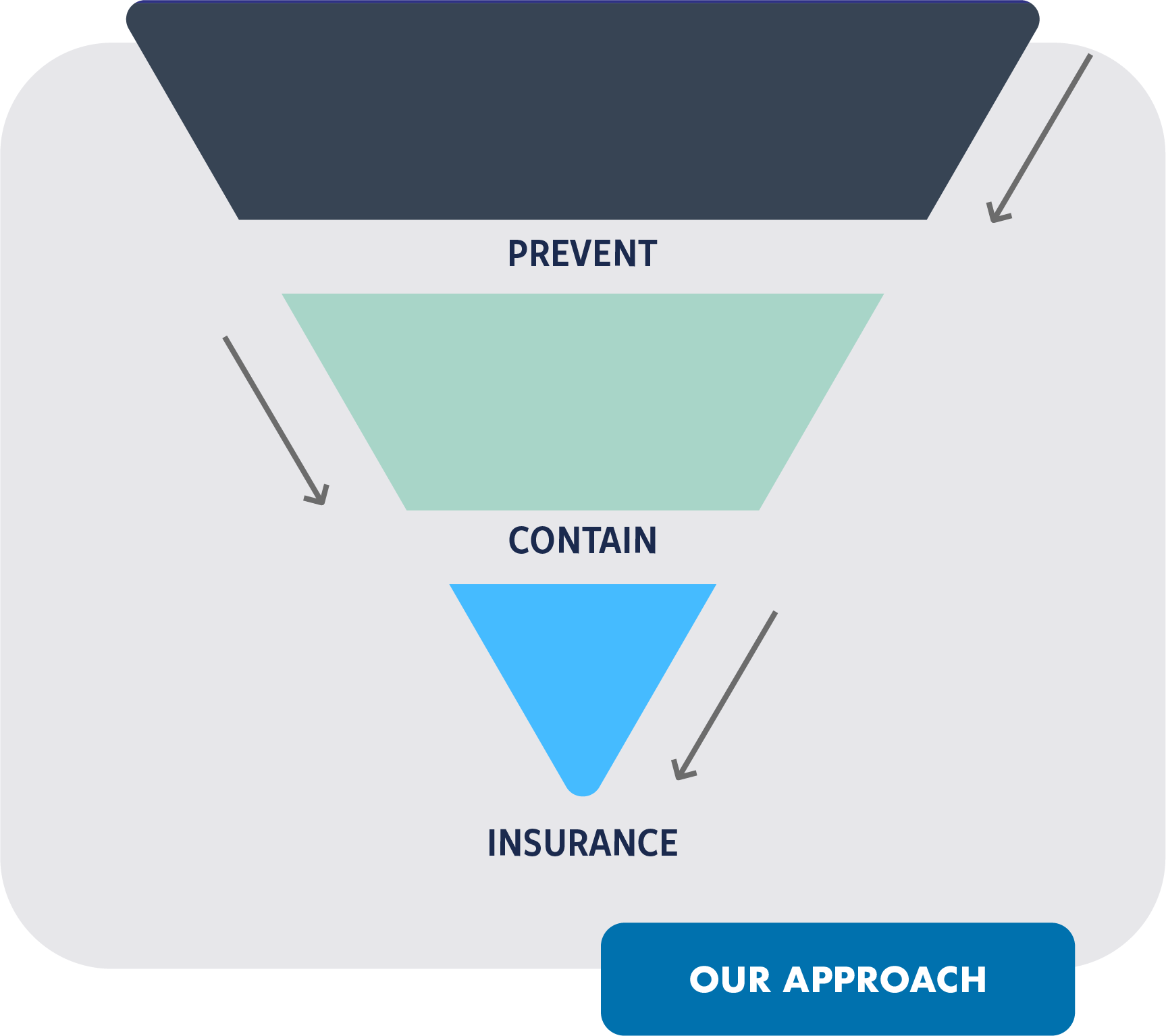

Whether you write commercial, benefits or work comp, protecting an employer against risk starts way before insurance. So many in our industry think of insurance as the ultimate safety net when in actuality, insurance is the least effective form of risk management. Yet, a vast majority of agents sell just insurance.

That’s not to say insurance isn’t critically important - it is. But for so many claims, the right steps would have prevented it from ever happening.